The rise of digital banking has introduced new avenues for financial fraudsters to exploit. To fight back against evolving fraud tactics, many financial institutions (FIs) are moving to strengthen their fraud controls. At the same time, customer expectations for fast, convenient banking experiences continue to grow.

Now, banks and credit unions are facing a tough — yet critical — challenge. They must figure out how to bolster their fraud controls while continuing to provide the fast and easy experiences people have come to expect from digital banking channels.

As vulnerabilities in traditional fraud management systems continue to be exposed, the need for data-driven fraud detection has become evident. And consortium data sharing is a trusted approach that is becoming even more dynamic with predictive modeling.

In this blog post, we’re offering a peek into a report from Datos Insights that explores the use of consortium data sharing for fraud prevention. Commissioned by Early Warning® and based on interviews with fraud executives, the report uncovers key findings FIs can use when considering whether to take a consortium data sharing approach to fraud detection and prevention.

Consortium data sharing is a pivotal tool for data-driven fraud detection.

Datos’ impact study highlights the following five things FIs should know about consortium data for fraud prevention:

- Knowing an individual’s current and past banking history is essential: Consortia data provides FIs with comprehensive insights about a consumer’s banking behaviors, accounts, transactions, and devices—as well as personal information such as addresses, email addresses, and employment history. This level of information is crucial for identifying suspicious patterns or uncharacteristic behaviors—and effectively predicting fraud risk.

- Not all shared databases are alike: Consortia databases exist within different frameworks and for various data types, including credit reporting agencies (CRAs) and vendor-specific consortia. These databases serve specific fraud prevention purposes and help FIs assess risk accurately across different channels.

- Consumers are embracing data sharing: Increasingly, consumers are giving consent for FIs to access and share their data across institutions—often to simplify loan applications or funds transfers. However, the systems that enable this type of data sharing (e.g., data aggregators that use APIs to gain a consumer’s consent) are often targets for fraudsters. To ensure data privacy and consumer trust, FIs must be diligent about maintaining data security and compliance.

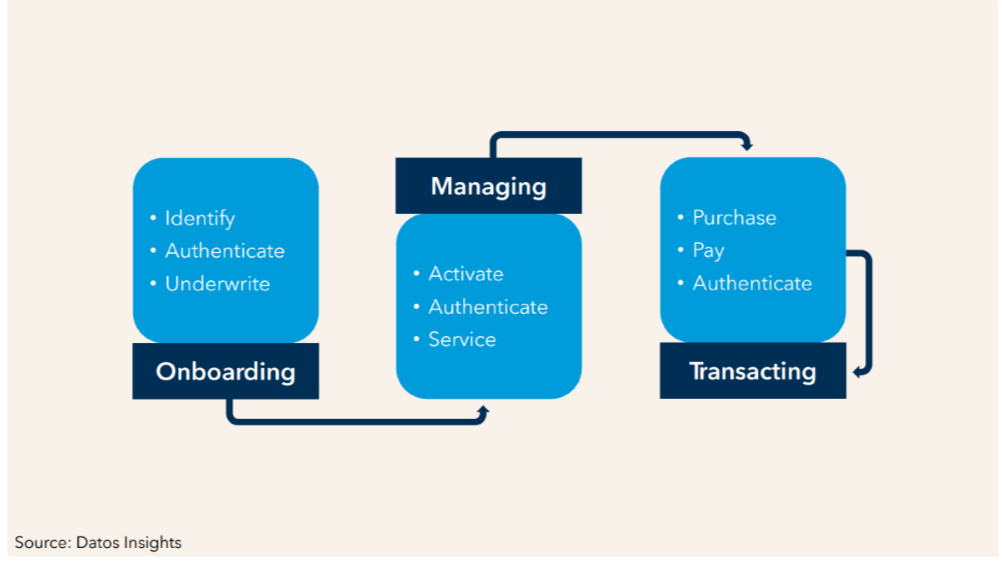

- Data sharing improves fraud prevention across the customer lifecycle: Shared data facilitates fraud prevention at every stage of the customer journey, from account origination to transaction approval. By analyzing shared data, FIs can streamline processes, improve the customer experience, and mitigate fraud risk effectively.

- Considerations for shared data usage: FIs must prioritize data privacy, security, and regulatory compliance when leveraging shared consortium data for fraud prevention. Establishing clear governance structures and adhering to industry regulations are essential to ensure ethical and responsible use of consumer data.

Early Warning customers benefit from consortium data sharing.

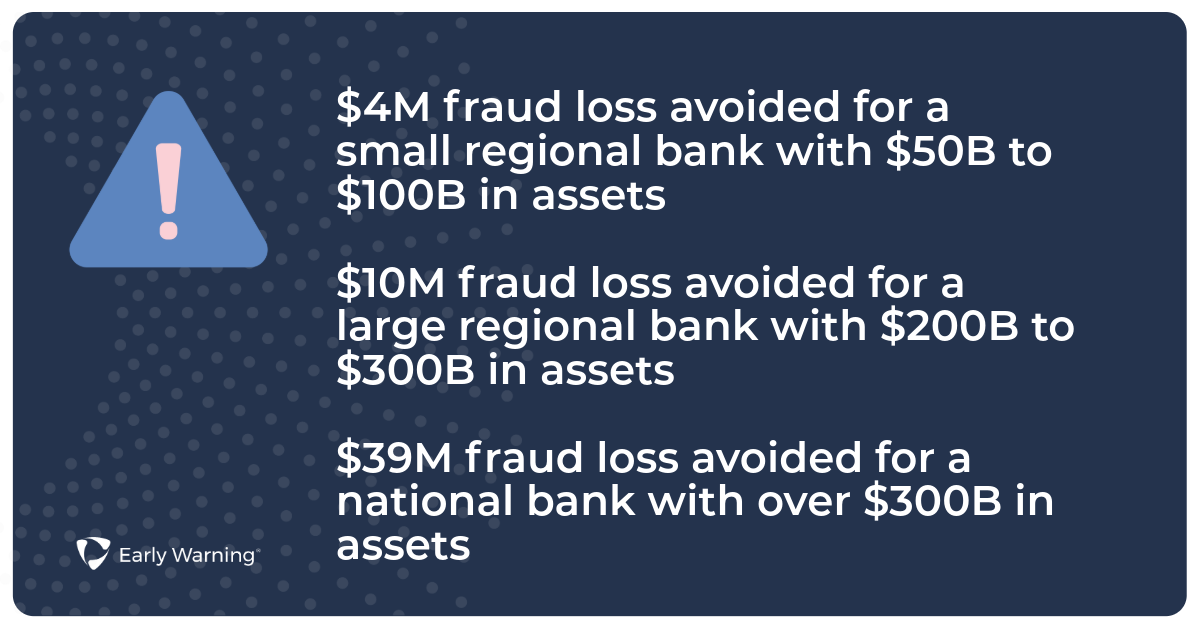

The National Shared DatabaseSM resource from Early Warning serves as a prime example of how FIs can benefit from consortium data sharing. Thousands of FIs regularly contribute data to Early Warning on a “give-to-get” model. Early Warning uses the contributed data to fuel its fraud and risk mitigation solutions. To illustrate the potential benefits of using consortium data for data-driven fraud detection and prevention, the Datos report examines a series of use cases across banks of all sizes, including:

There’s more to know about data-driven fraud detection.

Consortium data sharing can help improve data-driven fraud detection and prevention. Read the full impact report, Consortium Data Sharing: A Valuable Tool in Fighting Fraud and Abuse to explore more. It includes:

- A comprehensive view of the consortium data-sharing market landscape

- A deep dive into the benefits and challenges of using shared data for fraud prevention

- Real-world use cases showing how FIs of all sizes are using consortium data to avoid millions in potential fraud losses

- A list of actionable tips to help FIs get started with data-sharing consortia and achieve lasting success