No question about it: Artificial intelligence (AI) is booming. Advances in machine learning (ML)—and the emergence of generative AI in particular—are making big waves. And across the financial landscape, AI fraud prevention has become a major concern.

A 2024 Datos Insights report1 puts today’s rapid AI evolution into perspective:

Fraudsters are often early adopters of new technologies. So, it should come as no surprise that they’re already exploiting generative AI to devise new tactics—that make financial fraud easier to commit and harder to detect.

But it's not all doom and gloom.

Financial institutions (FIs) can fight fire with fire—using AI to improve their own fraud prevention strategies. Here we examine the growing risks and prime opportunities AI presents.

AI advances are fueling dangerous fraud threats

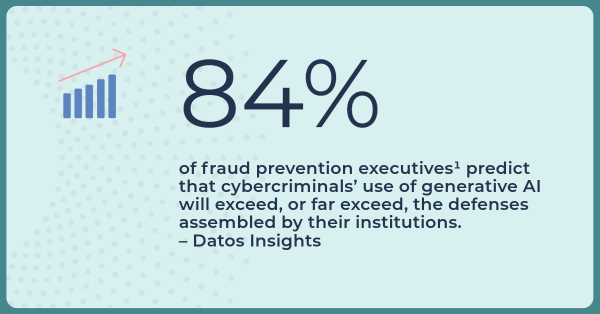

Generative AI is different from previous AI technologies—and it’s a potentially devastating tool in the hands of fraudsters. Most FIs are aware of the imminent threats.

Four generative AI capabilities that make AI fraud prevention more difficult include:

- Realism: Generative AI can produce highly realistic and convincing content, including texts, images, voices, and videos—making it nearly impossible to distinguish between what's real and what's fake. This increases the effectiveness of scams and fraud. For example, fraudsters can create emails that look indistinguishable from legitimate ones—to facilitate phishing scams or business email compromise attacks. Or they can generate fake credentials and documents (such as driver’s licenses, utility bills and bank statements), which they can use to open new accounts and pass identity verification checks.

- Scalability: AI can produce a large volume of fraudulent content quickly, allowing criminals to carry out large-scale attacks with minimal effort. Synthetic identity fraud, for example, is already a top concern among FIs. Now, fraudsters can use generative AI to commit synthetic identity fraud on a larger scale by automating and refining the creation of fake identities.

- Personalization: Machine learning algorithms analyze vast amounts of data to understand individual behaviors and preferences. This information is then used by generative AI to tailor fraudulent content specifically to the target, making scams much more personalized and harder to detect. For example, a phishing email could reference personal information, making it seem more legitimate to the recipient. Unlike traditional phishing, which might involve sending the same message to a large group, AI enables mass customization.

- Adaptation: Machine learning algorithms can learn from past successes and failures, enabling fraudsters to continuously improve their tactics. This adaptability means that as detection methods evolve, so too do the fraudulent techniques, creating a moving target for those trying to prevent fraud.

Notably, generative AI is still very much in its infancy. As AI capabilities continue to evolve, financial fraud will evolve along with it. Moving forward, effective AI fraud prevention will require ongoing innovation and investments.

Advances in AI are helping financial fraudsters steal on a larger scale, with less effort and better success. These same technologies are becoming vital for AI fraud prevention. The vast majority of FIs realize the urgency and are taking steps to bolster their fraud mitigation strategies. Datos’ 2024 impact report reveals that 47 percent of banks are executing proof-of-concept projects related to generative AI and an additional 35 percent are testing pilot use cases1.

AI and machine learning offers effective fraud prevention capabilities, including:

- Anomaly detection: By continuously learning from transactional data, customer behavior and communication patterns, machine learning models can identify suspicious activities that may indicate fraud. For instance, if a normally inactive account suddenly initiates a high-volume transaction, the system can flag the activity as potential fraud.

- Predictive analytics: Machine learning algorithms analyze historical data to identify risk indicators. This enables financial institutions to anticipate potential fraud before it occurs—and take preemptive action.

- Scalable and speedy data analysis: AI systems can process vast amounts of data from various sources in real-time. By integrating and analyzing this data, FIs can keep up with the growing variety and volumes of transactional data—and gain a comprehensive view of potential fraud risks.

- Adaptability: Machine learning models adapt and learn over time. As they’re exposed to more data, including confirmed instances of fraud, they refine their predictions and become more accurate.

At Early Warning®, we’re aware of the significant challenges FIs are facing—and we aim to help our customers stay ahead of evolving fraud trends. Payment Chek®, for example, analyzes data contributed by thousands of FIs using predictive intelligence and machine learning models. The service delivers risk scores and insights in real-time to help FIs better detect and prevent fraud—while maintaining smooth customer experiences. To learn more about how our solutions use AI and machine learning to improve fraud prevention, visit our website.

Sources

- “The Double-Edged Sword of Generative AI: Fraud Perpetration and Detection”, Datos Insights, January 2024