Synthetic identity fraud losses rose to an estimated $20 billion in 2020—spiking sharply from an estimated $6 billion in 20161. One of the fastest growing financial crimes in the U.S., synthetic identity fraud is now one of the nation’s leading identity fraud tactics.

To best combat sophisticated fraud, financial institutions (FIs) must also become sophisticated, using advanced analytics and predictive insights to better detect and shut down synthetic identity fraudsters.

In this blog post, we’ll look at why synthetic identity fraud is on the rise, why it is a particularly worrying tactic—and what FIs can do to prevent it.

Synthetic identity fraud emerged from the pandemic as a top attack pattern.

During the COVID-19 pandemic, a surge of new fraudsters emerged. Along with professional fraudsters and crime rings, this influx of “citizen fraudsters”2 saw a rare opportunity for financial gain that required minimal technical abilities—namely, the use of stolen and/or synthetic identities to get their hands on government stimulus payments.

Now, without trillions of dollars in stimulus money floating around, many fraudsters have shifted their focus to application fraud—which is achieved using the same types of identity fraud tactics they found so successful amid the pandemic.

Why is synthetic identity fraud so concerning?

Synthetic identity fraud is a mode of identity fraud in which a bad actor creates a fraudulent identity by combining real and/or fabricated personally identifiable information (PII)—and then uses that identity to commit fraud.

Creating synthetic identities has become much easier in recent years. Indeed, with 23 billion records breached since 20174, bad actors have access to enormous amounts of PII, at minimal cost.

Synthetic identities can be used to apply for a variety of financial products and services, such as bank accounts, loans and credit cards. If the application is approved, the resulting attacks can lead to significant losses for FIs—not to mention financial hardship and headaches for any unwitting victims whose PII was used in fabricating the fraudulent identity.

Here’s a nutshell version of how synthetic identity fraud works—and why it’s so hard to detect.

Playing the long game, savvy fraudsters will often nurture synthetic identities for more than a year (responsibly managing their bank accounts; making on-time credit card payments) to establish a strong credit record—before initiating their attack.

Using a synthetic identity that has been well-nurtured, for example, a fraudster can get approved for a hefty loan or high-limit credit card; cash-out the loan and/or max out the card; and then disappear into thin air without making a single payment.

Synthetic identity fraud is particularly enticing to criminals for three main reasons:

- they are relatively easy to create and/or obtain

- they are difficult to detect

- they offer big paydays—to the tune of $81,000 to $97,000 per synthetic identity fraud profile5

How can FIs detect sophisticated synthetic identities?

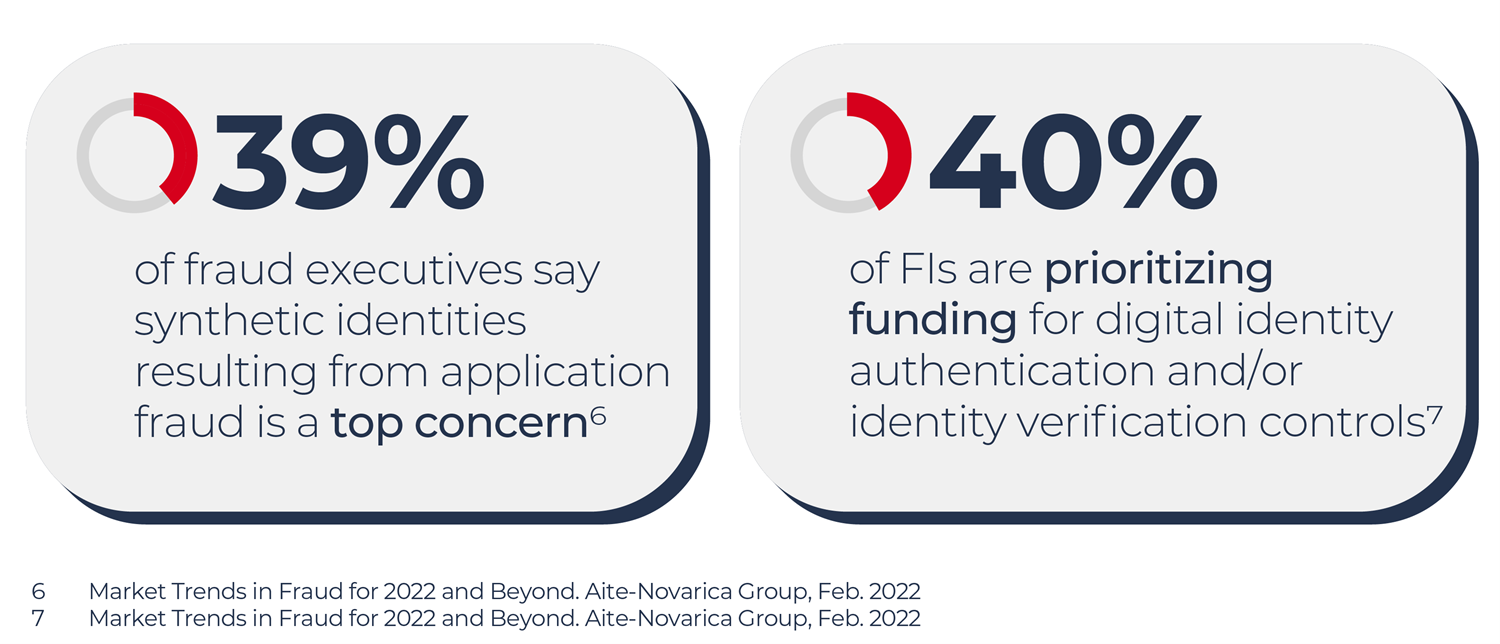

FIs are well aware of the dangers of synthetic identity fraud.

To help prevent synthetic identity fraud, an FI’s application system must be able to do two key things:

- Determine whether an applicant is presenting their true identity credentials

- Detect synthetic identities and stop them from entering the system (while quickly advancing legitimate applicants)

Modern identity verification solutions enable FIs to extend their fraud prevention capabilities. Using data contributed from a vast network of banks, Verify Identity from Early Warning® employs predictive analytics and scoring tools to reliably identify suspect identities. ID Confidence Score and Synthetics Indicator, for example, significantly increase identity confidence by analyzing data from all identities in the network (versus a straight database match)—to reveal telling patterns of mismatch, manipulation and sharing, while Verify SSN confirms whether personal information matches a legitimate Social Security record*.

Learn more about how Early Warning can help you confidently verify consumer identities.